23 Oct MRTA vs MLTA

Most Malaysians do not know enough about proper home financing.

Many Malaysians are risking unsettled home loans in the event of accidents or sudden deaths. Thus, transferring the burden of mortgage repayment to their loved ones.

This is where choosing the right mortgage insurance is important. A good home insurance can be the difference between putting your family in a good financial position or a difficult one.

What is a Mortgage Insurance?

Firstly, a Mortgage Insurance is an insurance policy that aids to cover your outstanding property loan such as a mortgage if you are unable to do so in the event of death or total permanent disability. It compensates lenders or investors for losses due to the default of a mortgage loan. Without this, your property might be repossessed and be auctioned off if your family fails to repay the remaining balance on the loan.

MRTA vs MLTA

There are two kinds of mortgage life insurance for homebuyers in Malaysia. The first being, Mortgage Reducing Term Assurance (MRTA) and the second being Mortgage Level Term Assurance (MLTA).

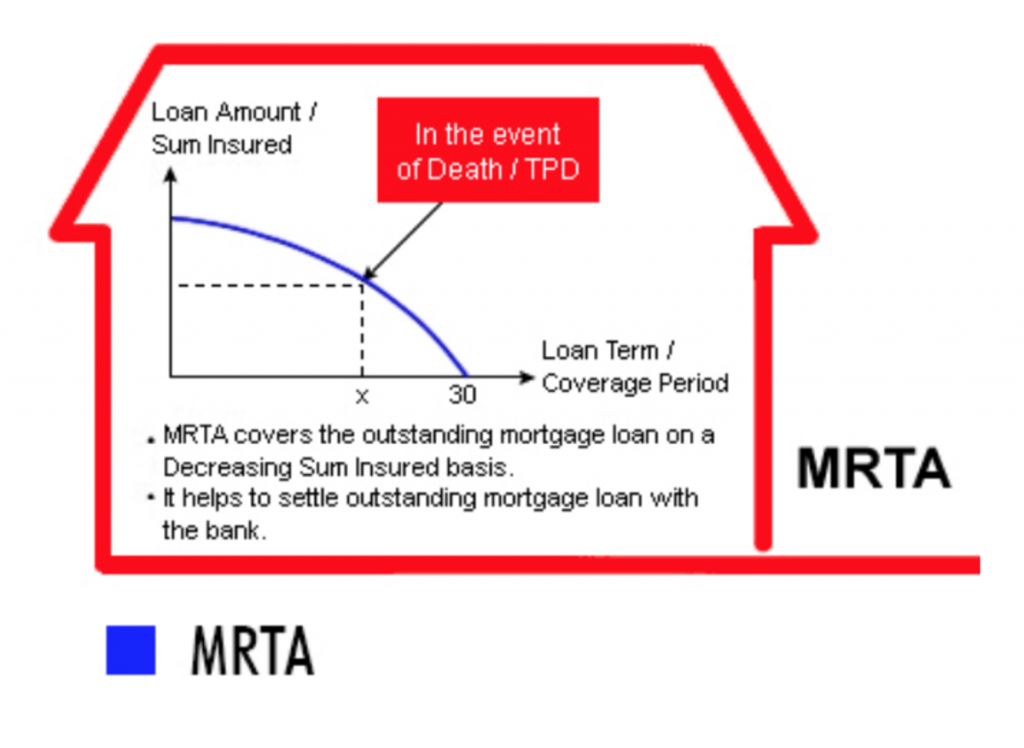

MRTA aims to protect borrowers from death or temporary partial disability (TPD). However one must take note that the sum insured will reduce annually until it reaches zero at the end of the tenure. If something were to happen to you during that period, the insurance company would only pay the claim according to that year’s coverage.

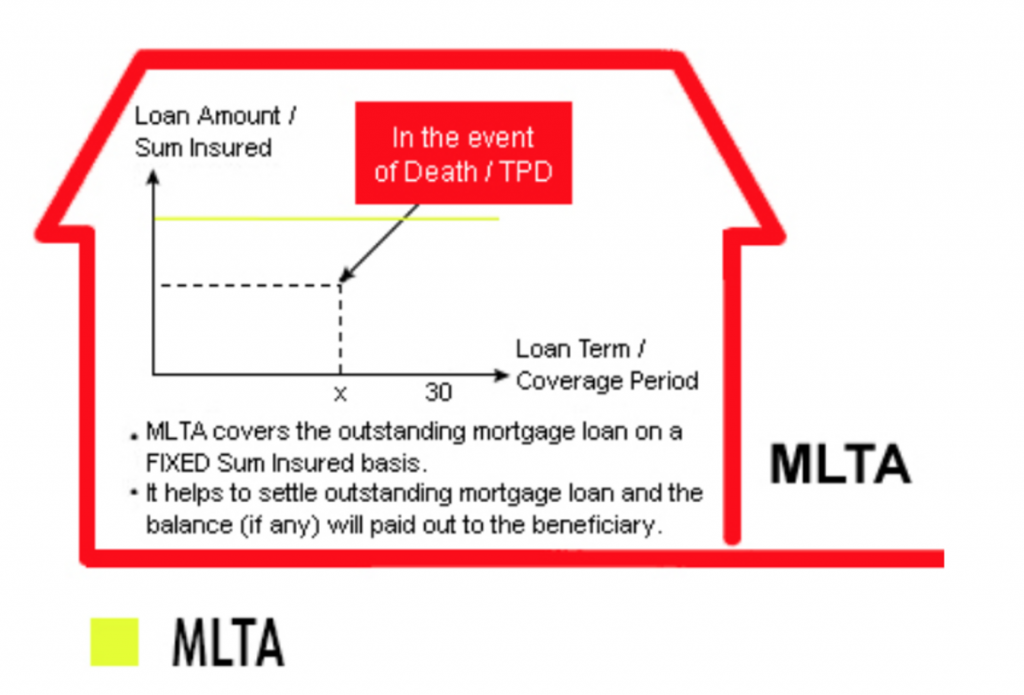

MLTA is also a loan protection but the main difference between MLTA and MRTA is that MLTA’s sum assured will not be reduced during the length of the loan financing. The amount covered will remain fixed for the whole tenure. Thus, the outstanding principal loan amount would not change.

This diagram shows how your premium payments would be for MRTA vs MLTA

Which one should you choose?

The diagram below showcases the differences between MRTA and MLTA. Both policies offer different benefits that are suited for different individuals and homes.

If you’re still having trouble with deciding which of these mortgage insurances are the right one for you, you can visit Smart Finance Malaysia and consult a licensed financial planner to help analyze your current financial standpoint, provide you with ample financial advice, or even help create a comprehensive financial strategy for you. Sign up now for a free account today!

No Comments