02 Nov 5 steps to take to have a successful estate.

Follow these simple steps to start planning your estate

The hardest part about planning your estate is actually starting. With these quick and easy tips you will have your estate sorted in no time. So let’s get started!

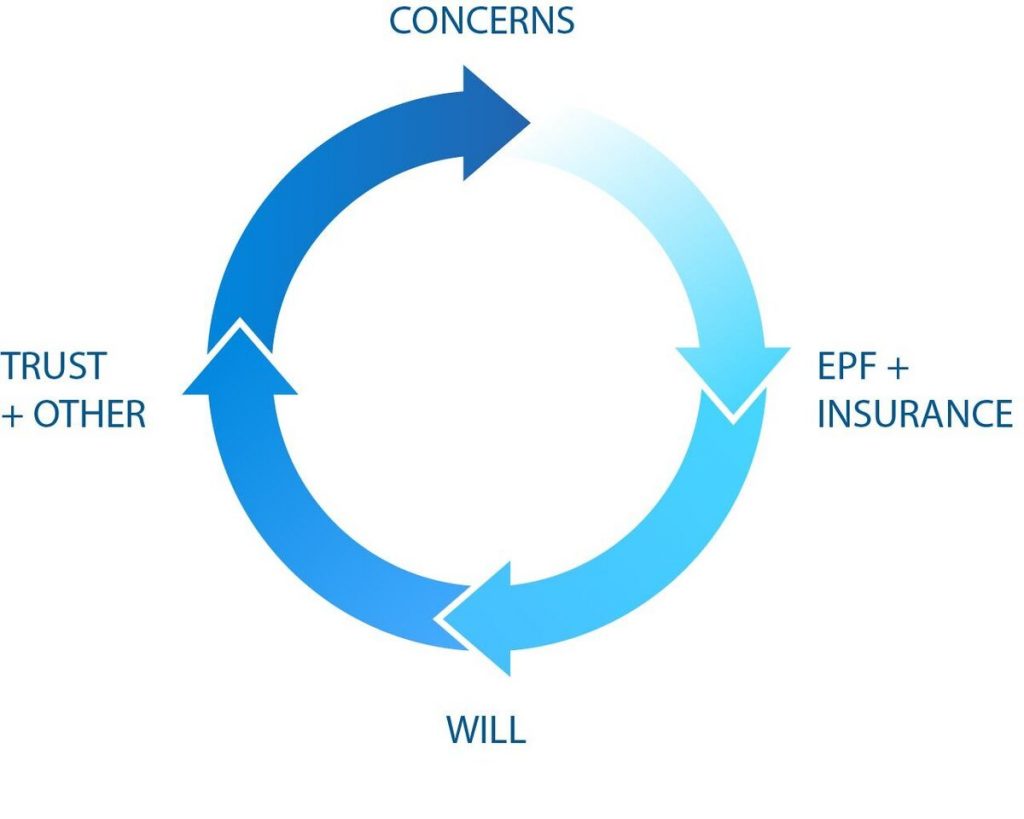

STEP 1: Start with a List of your concerns.

Your list of concerns should highlight what you would like done for your estate. It can be items for particular individuals, money to charities or certain funeral arrangements. Highlighting your concerns helps clarify what you would prefer early.

STEP 2: Start with a nomination for your EPF and insurance.

Take the time to do some research into your EPF fund and your insurance provided. Making sure you are aware of your policies can ensure ease and accessibility in the future. Only 56% of the Malaysian population have life insurance. If you haven’t got life insurance, now is the time to get it. Life insurance allows for you to protect your family incase your unable to do so yourself.

STEP 3: Write a will.

A will provides the basis of an estate plan. Regardless of the assets you maintain, it is necessary for a will to be written. A will outlines who particular assets will be distributed to and helps avoids potential family disputes. If no will is made it allows for items to be distributed by the Distribution Act 1958 rather than your wishes.

STEP 4: Begin a trust and other estate planning options.

Creating a will is the first item for your Estate plan. There are many other planning options available to you.

● Durable power of attorney

● Beneficiary designations

● Letter of intent

● Healthcare power of attorney

● Guardianship designations

STEP 5: Get financial advice.

Seeking Financial advice is always a good idea. You can receive advice from lawyers and members of STEP (Society of Trust and Estate Practitioners). Financial advisors have expertise and networking to provide you with comprehensive advice. It’s necessary to get financial advice to ensure documents are written correctly.

We understand Estate planning can be difficult. That’s why you should contact the financial advisors at Smart finance. When you sign up at Smart Finance you can receive a free consultation with a financial planner.

Confused on where to get help? Smart finance is the answer.

Need more reasons to sign up?

● Free to join platform

● Easy to understand video lessons

● Set goals

● Real time tracking

No Comments