15 Nov What You Need To Know About Auctioned Properties

Afraid of property abandonment? Or maybe you’re just too lazy to go through the lengthy and tedious process of purchasing a new home. There is another option of homes called auctioned properties. An auction property is real estate that has been foreclosed by a bank or the High Court, due to the owner failing to settle the payment for mortgages or quit rent.

Based on AuctionGuru.com.my, the amount of properties that are being put up for auction is moving in an upward trend.

A total number of 6,225 residential properties valued at RM1.78bil were put up for auction in 2017. This constitutes a 31% increase from the same period last year, and a 61% increase compared to the year before.

If you are someone who wants to dive into the world of property auctioning and snatch yourself a winning bid, here are some pointers to look out for.

1. Picking the right property

For someone new to the property auction scene, they may not know how to find a foreclosure property with good investment potential or know whether the reserve price is attractive enough for them to bid. To begin with, always keep an eye out on properties in established areas. Such examples are places like Mont’ Kiara, Kota Damansara, Cheras, or Seri Kembangan as stated by Twincrest Properties Sdn Bhd as these locations have a steady demand for renting and buying. Besides that, one should compare the reserve price against similar properties in the area.

2. Know your surroundings

The next thing to do is to visit your targeted property.

- Inspect the condition of the building

- Understand the surroundings

- Conduct comparative study for potential appreciation

- Conduct study on the rental prices

- Perform external inspection

- Find out details about the previous owner from neighbours

- Find out if the property is still occupied or not

3. Do your research

Conduct a title search at a relevant land office. Why? Because of such a thing called a caveat. Caveat’s are a big issue in property auctions. Most bidders would think twice before bidding on a property with a caveat on it.

A caveat is a temporary measure to protect the rights of the land. A private caveat serves as a purpose of protecting an individual’s rights under the sale and purchase agreement temporarily, in anticipation of legal proceedings that he lodges the private caveat. Thus a private caveat will cause a hindrance as it will prevent any dealings from registering to even change of ownership while the private caveat is in force. A private caveat also means that banks may not finance the property. However, the caveat can be removed by filing an application to the court. The process however is a huge hassle and will take about two to three months to complete. Conduct a title search at the relevant land office.

4. Be prepared

Firstly, obtain a copy of the proclamation of sale (POS) and conditions of sale (COS) from the auctioneer or solicitor to understand the terms and conditions of the sale.

Primarily check if the property has any outstanding bills like quit rent, assessment, maintenance charges, and utility bills yet to be settled. Find out which party is responsible for these bills.T he deposit you have to prepare and the cost to be undertaken or excluded by the financial institutions. Besides that, you are advised to check your eligibility for mortgage loan and seek legal advice on the COS prior to the auction.

Materials to Prepare

- MyKad for registration purposes

- Bank Draft/Banker’s Cheque amounting to 5% or 10%

- Extra cash on auction day to top up the difference on the deposit sum between the successful bidding price and the reserve price

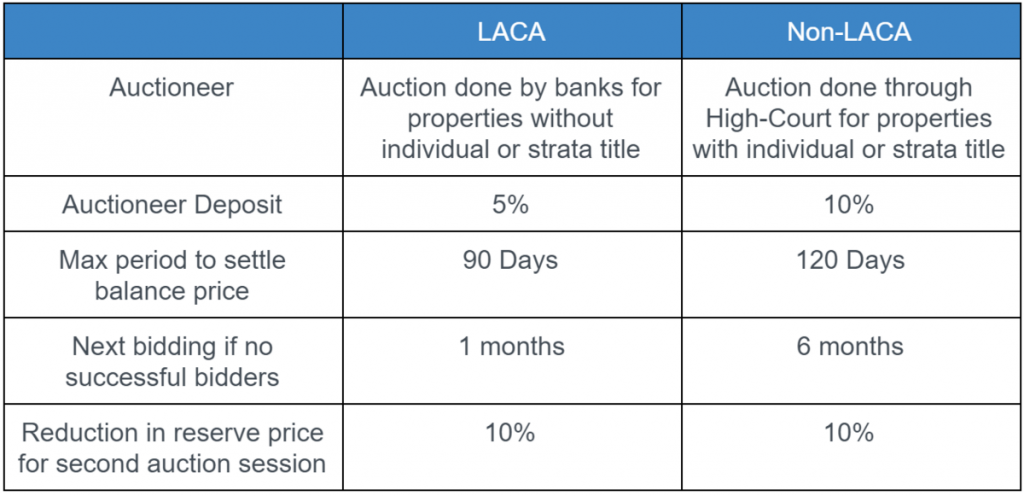

5. LACA and Non-LACA

Both have different terms for the payment of these.

LACA (Loan Agreement Cum Assignment) – auction done by banks for properties without individual/strata title. The outstanding bills are borne by the bank only up to the date of auction. Typically, the amount is deductible from the balance purchase price but sometimes you will need to pay all the outstanding bills first,then submit a claim to the bank for its portion through your lawyer.

Non-LACA – auction done through High Court for properties with individual/strata title.

The outstanding bills are calculated up to the date of auction and later settled using the balance purchase price settlement.

6. The Experience

During auction day, the atmosphere can be very face paced. If you aren’t mentally ready you can fall behind very quick in the crowd. To start off, attend and experience as many auctions possible to learn. Don’t be afraid to ask for advice from people whom have been through it before. Listen and learn how other buyers or bidders do it.

7. Don’t Be Greedy

Setting a limit is crucial. You don’t want to end up overbidding on a property. The whole idea of buying a auctioned property is to get it as “value buy”. Understand your own spending ability and know when to go up or stop bidding. Always take note that there are other costs such as legal fees, finance fees, and stamp duties to cover as well.

There are its pros and cons to auctioned houses. Whether you decide on an auctioned property or a new one solely depends on you. If you’re wondering how auction houses came to be in the first place, here’s a video link to understand more about how it happens. https://smartfinance.my/lessons/7

If you need help in analyzing your own financial standpoint or knowing whether or not if it’s wise for you to buy an auctioned property, consult a financial planner. At SmartFinance, we have licensed financial planners who are experts in understanding and managing people’s finances, they will help you ease the burden of deciding on a new home.

* Free to join platform

* Easy to understand video lessons

* Real-time tracking of your personal finances

* Set goals

No Comments