28 Nov The SST is back! Here’s what you need to know

So now that you know about tax, let’s take a closer look at SST.

You’re not the only one that’s confused about this new tax on certain food and beverages.

The food culture in Malaysia is unlike anywhere else. We love our food!

And if you love food as much as I do, you’re eating out many times a week, if not a day. You may have started to notice, some places are charging SST for their food and beverage.

Here is a rundown of everything you need to know about SST.

We will cover what it is, who it affects and food exempt from SST.

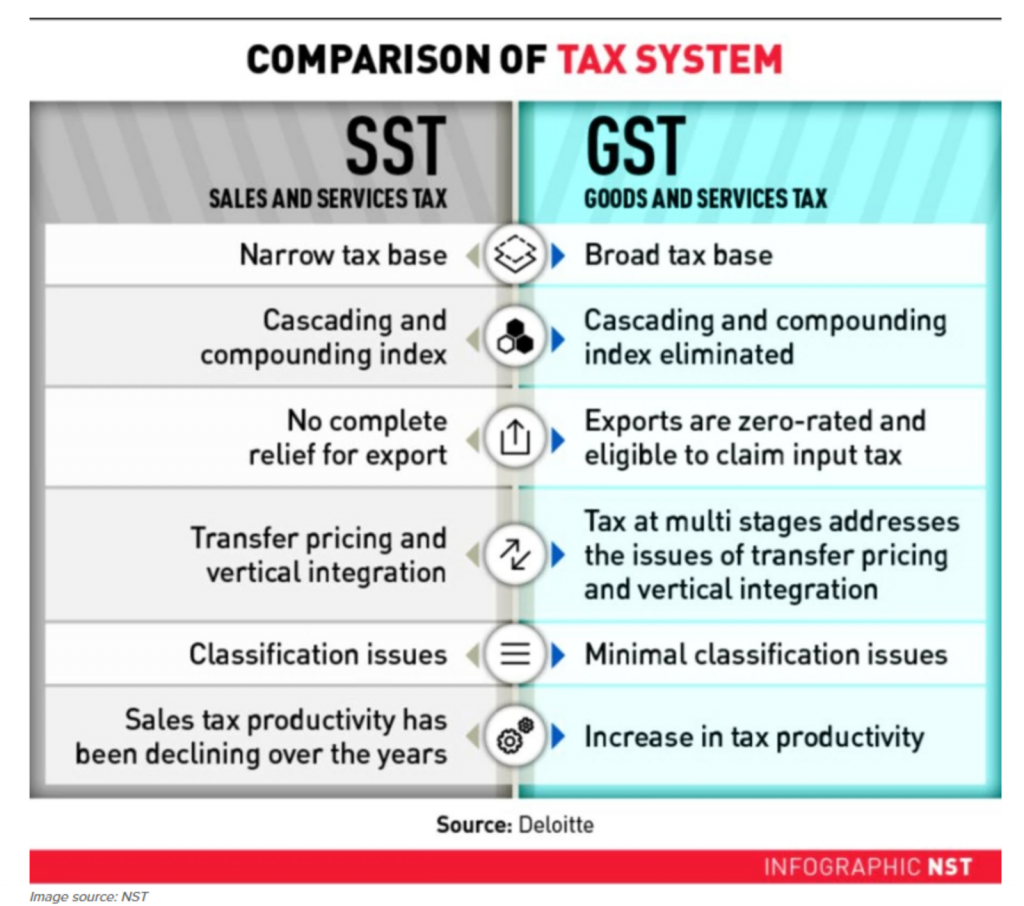

SST & GST

SST is the Sales and Services Tax. Since the June 2018, sales and service outlets add SST if their income is RM 1.5m plus per year. This tax can range from 6-10% of your total purchase.

For GST, Goods and Services Tax, the outlet would have to have a minmum of RM 500,000 annual income. Due to the reintroduction of the SST, GST is at 0% and there are now fewer outlets which need to charge tax.

Martijn Koning compared these two taxes side by side:

Who does the SST affect?

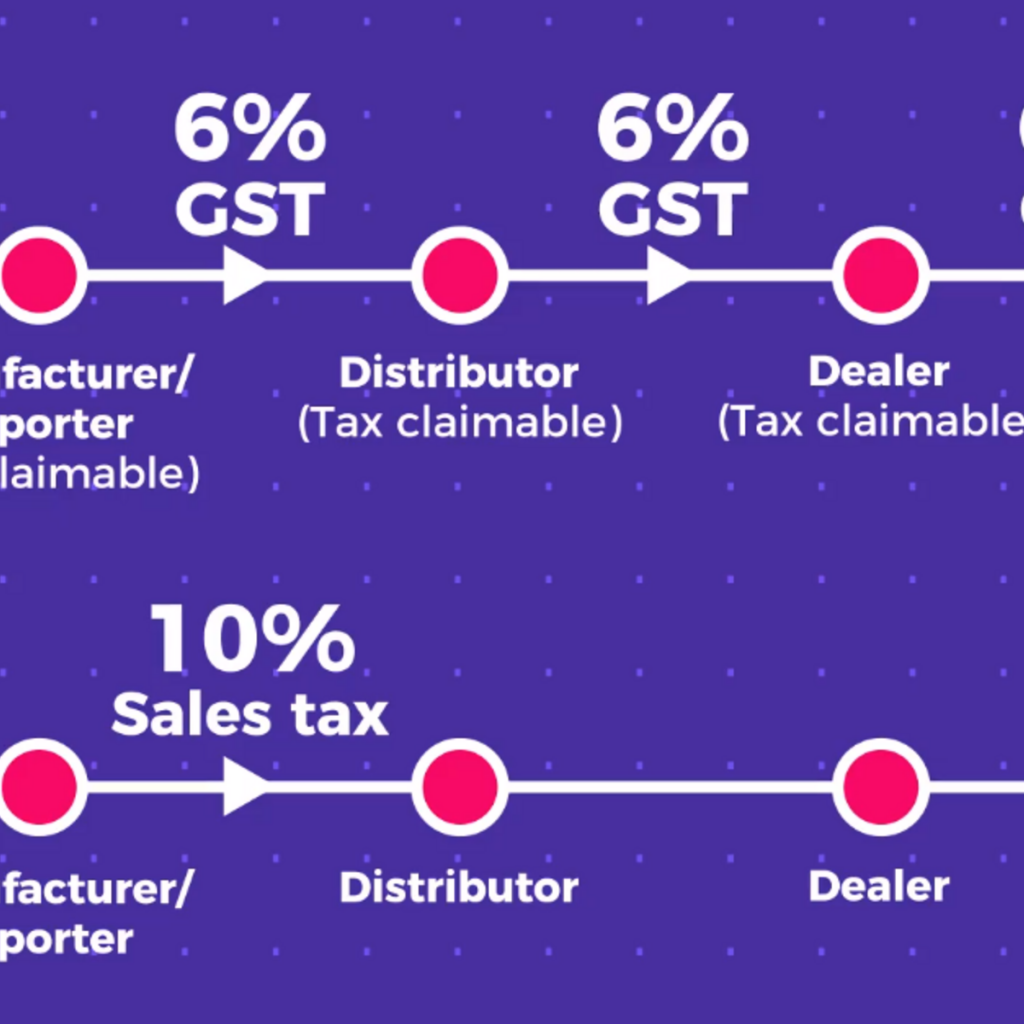

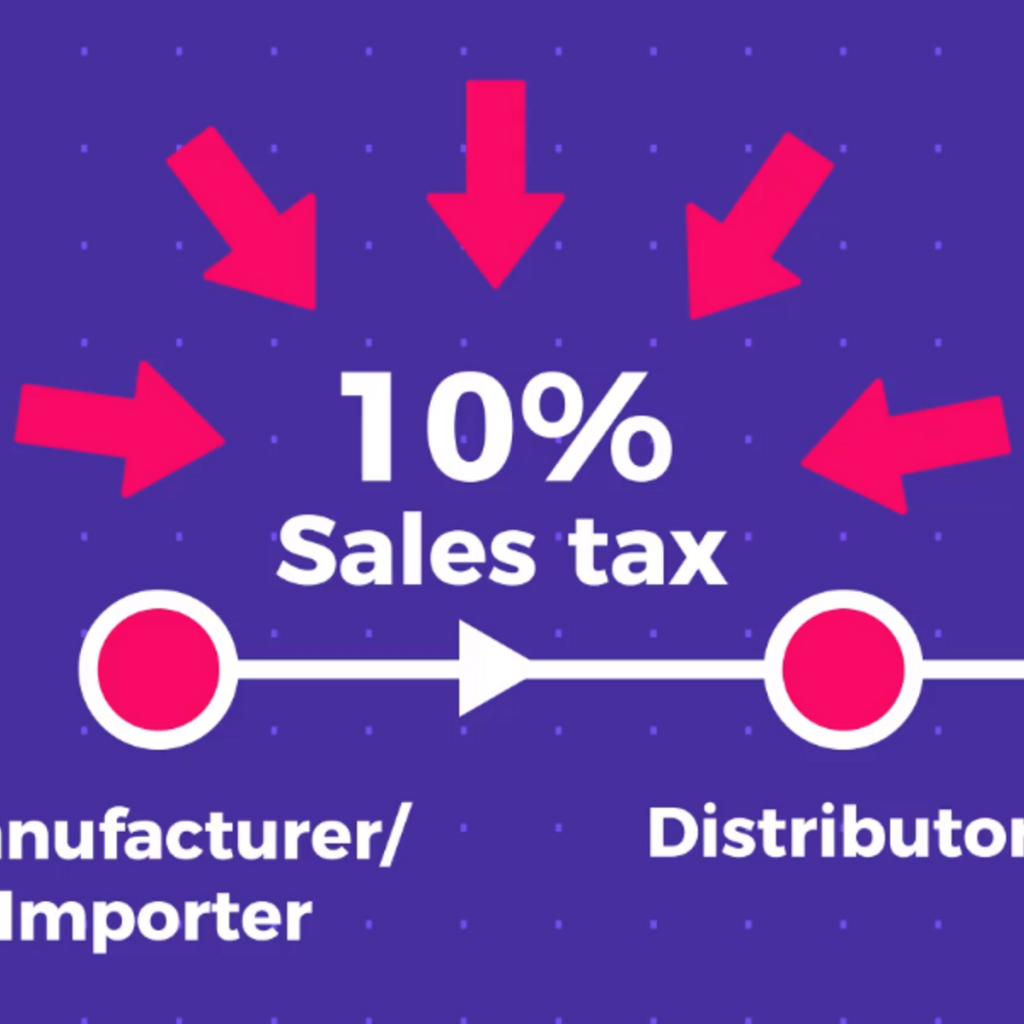

In order for you to understand what SST, you need to understand the supply chain. The supply chain are the different channels food and beverages go through before we eat or drink it.

The Sales and Services tax goes to the start of the supply chain; the manufacurers or importers. This tax can vary between 6% to 10% of the total cost. The SST also goes towards the profit of the restaurants and sallary of the staff.

Which places will charge SST?

As mentioned before, places which have over RM 1.5 million yearly income will have taxable items.

“Under the GST system, there were 17,574 restaurants that had registered their businesses… However, after the government raised the SST annual turnover threshold to RM1.5 million from RM500,000, a total of 4,372 restaurants had registered their businesses,” – Finance Minister, Lim Guan Eng

Items exempt of SST

- unprocessed meat

- vegetables

- rice

- fruits

- fish & seafood

Where to from here

Off to your favourite restaurant!

but before you spend all your money on food …

Check out Smart Finance

Here they offer:

- No joining fee

- Tools to create your financial plan

- Free consultation with any finance planner listed

- Short video lessons about managing all sorts of finances

Ok … you may eat now! 😂

No Comments