29 Nov 10 hacks to save money in Malaysia

It’s easier than you think

We all want to save money, but sometimes we do enjoy spending our money. Yet, there are a life hacks outthere that will allow you to feast like a king, but also save you money. Keep reading below to see our top 10 hacks for saving money in Malaysia.

1. Swap your grab for the train.

I know! Catching a Grab is convenient. It comes straight to your door and drives straight to your desired location. But if there’s a train station near you, take it! They save you money and maybe even help you achieve your daily steps 😉

2. Take your lunch to work.

Yes, I know eating out here in Malaysia is cheap. Yet, meal prep can actually help you save money + benefit your health. Research cost-effective meal plans

3. Ditch the soft drink.

Might be nice to have a glass of coke with your meal yet at 2RM a can, it can get expensive. Switch your desired beverage for water and you will see

4. Quit smoking, or at least limit.

One that’s very hard to do but can save you money. Try to lower your consumption, in the hopes of one day quitting. Beneficial to your health but also your wallet.

5. Water bottle.

It may be convenient to buy water, yet buying water in bulk is cost-effective. Buy buying water in bulk it not only saves you money but also the environment.

6. Ditch the gym and head outdoors.

The gym may be nice with its air-conditioning. Yet, the gym fees aren’t as nice. One way to save money is to head outdoors or do at home workouts. With great apps available, working out at home has never been easy.

7. Unfollow those shopping accounts.

Unsubscribe and unfollow all your shopping accounts. It’s too easy to see a good deal online and next minute you are entering your credit card info. If the temptation isn’t there you are less likely to spend.

8. Ditch pay entertainment or share with others.

Paying for Netflix and Spotify are extra monthly costs. If you can’t get rid of them, sharing the load with others.

9. Swap the credit card to a debit card.

Credit cards are fun and games until you can’t make the repayments. This is why a debit card is always a good way to go

10. Meat-free Mondays.

A concept for health, meat-free Mondays can help save you money. By taking out meat out of your diet you will find you spend less money as vegetarian dishes are often cheaper.

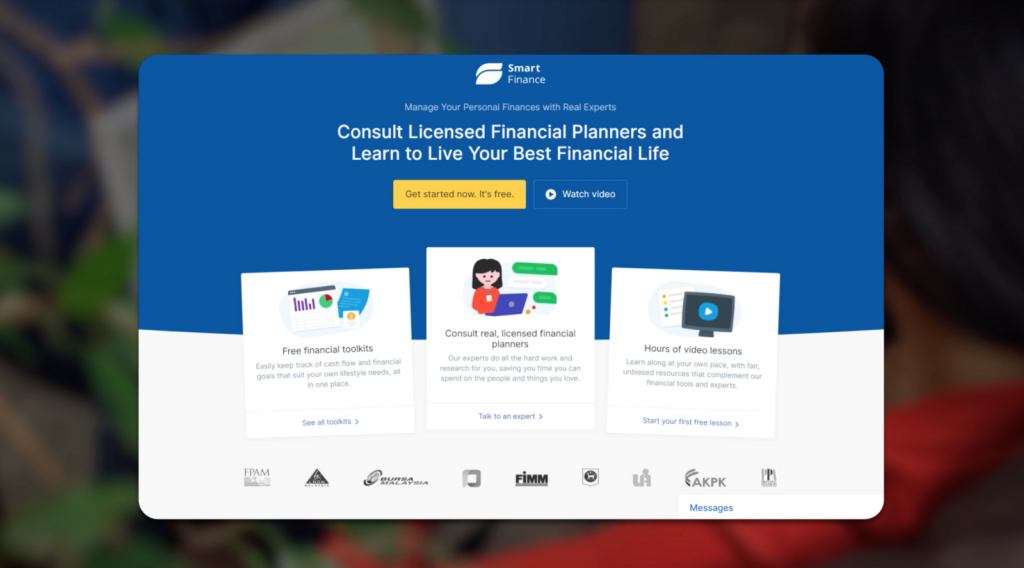

Want to see more ways you can save money? Create an account on SmartFinance.my now and access our library of video lessons for free to learn more about the taxes that impact you financially. You’ll be able to select related topics quickly via keywords to view bite-sized lessons. While at it, their financial tools are also a great resource to manage your finances once and for all.

Need more financial tips like this ?

- Free to join platform

- Easy to understand video lessons

- Real-time tracking of your personal finances

- Set goals

No Comments