11 Mar Must Know: Housing Loan Malaysia Guide (2019)

Getting a housing loan in Malaysia is relatively easy but how do you know if you can afford one?

Buying a house is one of the significant steps as an adult, and it is a huge financial commitment. Usually, housing loan Malaysia is easy and fast to get. You may have scouted for the perfect house with the right price tag on it. But, I bet you are unsure about how much you should settle for the downpayment. Correct? Or whether banks are offering you the best interest rates?

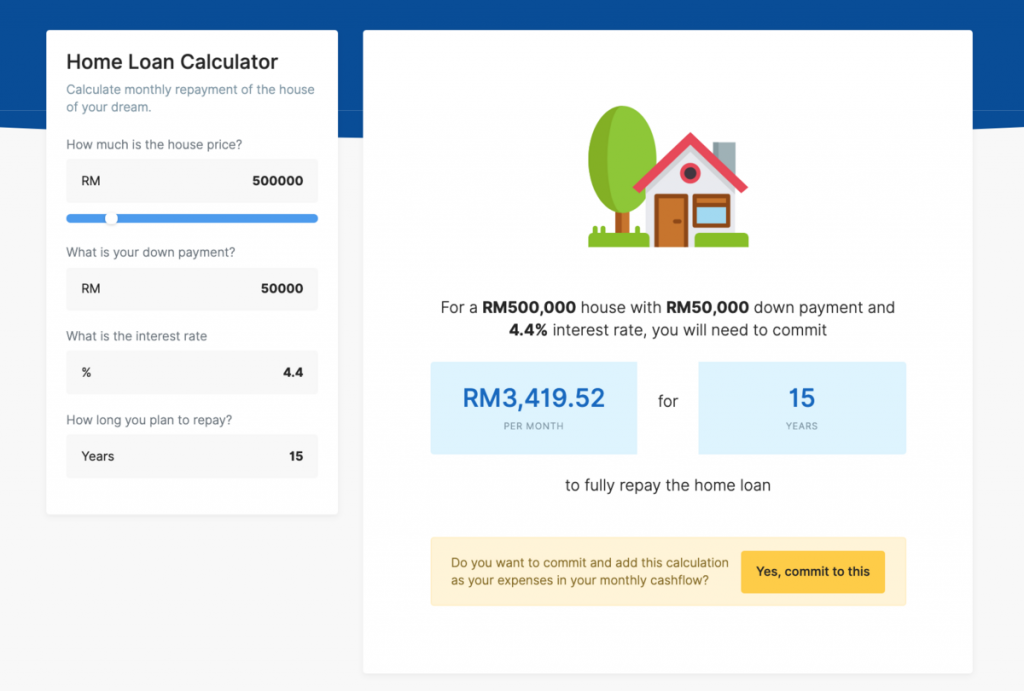

Don’t worry. SmartFinance has you covered with our free-to-use housing loan calculator

First of all, determine the downpayment you are planning to pay forth. It is at a percentage of the full price of the house, which is usually 10% but you can pay higher than that. It is good for you in the long run to pay a larger amount than the standard percentage. Yet , if let’s say you are unable to put forth the downpayment at all, it is better to restrain yourself from buying it now.

Figure out which interest rate is right for you. The housing loan Malaysia interest rates can be below 5% with certain banks have a base rate they need to follow. There are two types of interest rate, fixed interest rate and variable interest rate. With the latter, the interest rate is higher, then the higher you will need to pay monthly and vice-versa. Be aware of the interest rate that is available for your loan and how it will affect your loan period. It is better for you to get the loan with a low-interest rate as you pay lesser per month and it will help you in the long run.

You’ll need to figure out the loan period, which is how long you will take to pay up for the house loan. This process depends on your income and how much you can afford to pay monthly. You won’t be able to pay for the house in 10 years, which is why most of the houses are being paid for extends up until 30 years. Of course, this is depending on the value of the house itself.

For example, let’s assume you are newly-wed, you have saved up for only the downpayment with a joint salary of RM 4,200. You need to commit RM 2,100 per month to pay your instalments, leaving you to live off RM 2,100. After counting your monthly savings and other commitments, your disposable income is down to about RM600 to RM800.

Because of this, you will need to consider your monthly spendings while you are committing to the house loan.

A house in a good location is always more expensive due to the convenience for it can provide for the owners. Assuming that they have a stable paycheck with a raise, it is ideal to buy a house when you have a steady career and need a permanent house.

You will also need to see if your loan has an early termination penalty if you pay before your tenure expires. This process is known as a lock-in period. This can happen during a time-frame of 2 to 5 years of the loan tenure, with the fine being a percentage of your house loan. Fortunately in Malaysia, some house loans have no such penalties within their agreements. So, you will need to keep an eye on this factor in the events that you wish to refinance to another bank in the far future.

One of the few things you might want to consider when taking up a house loan is having a guarantor for it. The role of the guarantor is to assist you in paying for the loan; usually, this person would be a family member. But, do keep in mind that is not easy as you will need to agree with them if you are unable to pay for the loan. Remember, this is a huge commitment and your guarantor can be sued for bankruptcy if they or you are unable to pay up.

Aside from that, there are also other incidental fees related to buying of a house. These are usually legal fees, stamp duties and the likes. It may seem like minor at first, but these are important in the proper processing of your house loan Malaysia. It is also to ensure you are ready to pay for these while you are planning to budget for the house mentioned above.

Another lesser-known factor in regards to your getting a house loan is your credit score. Credit score or credit rating is used by banks and financial institutions to know if you are qualified to get a loan. This is based on the outstanding debt that you may have, which can range from personal loans, student loans or hire-purchase loans.

What this means is, if you have a good credit score (where you pay off your debts in time with no outstanding sum), you can receive the approval for your mortgage within hours, rather than weeks.

Yet, if you have low credit health, in which you do not repay your debts to the bank in time, they will not grant you the loan that you need for the house. In case you have debts such as paying for your credit card debt or student loans, it is wise to pay off those first before you plan to buy a house.

If owning a house is part of your life goals, be sure that you are both financially and mentally ready to be able to repay for the house loan for the long run. You can sign up on SmartFinance.my to use your dashboard to start managing your finances for the future house. Or, get a free consultation with our many certified financial planners for further advice about the home of your dreams.

No Comments