19 Jul Thinking of Hiring a Financial Planner in Malaysia?

10 Things you need to know to get started

As you strive to reach your financial goals, you may consider turning to a financial planner for professional help, especially if you are busy with other life commitments.

Yes, it’s true that hiring a financial planner is not as simple as hiring a helper. You need to consider carefully who you are trusting with your personal money and assets matters.

Naturally, we have questions like

- Where to look for one?

- How to know they are trusted?

- How much do they cost?

That is why we write this guide.

If you are someone who is considering hiring a financial planner in the near future, you would find this guide useful.

1. Only Hire Licensed Financial Planners

Unfortunately, there are many individuals in the financial industry who call themselves “financial planner” or “financial advisor”.

Typically, these individuals are not licensed by either Bank Negara or the Securities Commission. It is also vital to ensure whether their academic qualifications are recognised by relevant authorities like the Financial Planning Association Malaysia.

What to do?

Check with the professional body which they are affiliated with or check the Securities Commission’s website at sc.com.my, or only hire your financial planners through smartfinance.my

2. Hire Financial Planners with Adequate Experience

We recommend financial planners who are experienced enough and has the relevant specialisations to help you meet your financial goals.

3. Hire Financial Planners who are Trustworthy and Open

How comfortable you felt when you talk to them? Your financial planner should be someone who is not afraid to tell you painful truths about your financial situation. At the same time, they should be tactful enough to guide you through your financial journey.

4. Hire Financial Planners who Disclose their Compensation Structure

Financial Planners typically make a living from charging clients their services. The compensation structure is typically a flat fee, hourly rate, or even performance-based fees. There are also occasions they earn a commision from recommending financial products to you. It is in your interest to agree on a compensation structure before any official engagement. Make sure they are incentivised to help you achieve your financial goals in an unbiased manner for the long-term.

5. Hire a Financial Planner who provides Ongoing Service

You must manage this relationship like your marriage or like the relationship with your significant other. Whether you want to meet annually to review the plan or more frequently to monitor the progress of a plan is also a factor to be considered when hiring a financial planner Ideally, the financial planner is committed to develop a long-term relationship with you. It is of no help to you if they never contact you again after delivering your financial plan for you. You need someone who can provide constant guidance and keeping you accountable to your financial objectives.

6. Hire a Financial Planner who would Assess Your Existing Financial Situations

Your engagement with a financial planner should start with reviewing all your financial records and expectations like family’s savings, debts, investment goals, risk tolerance, retirement plans, health issues, etc. This is critical to help you identify your financial goals before embarking on constructing a financial plan that is tailored to your specific needs.

7. Hire a Financial Planner who would explain the Pros and Cons between Options

The financial planner has a responsibility to explain the different options available to you before any official recommendation. Although you might end up choosing their recommendation, it is also important for them to be transparent to you on how they reach their proposed solutions.

8. Hire a Financial Planner is Open to Refer you to Other Professionals

An ethical financial planner should be able to refer you to other relevant authorised licensed professionals. Not all financial planners are “jack-of-all-trades”. Some specialise in different areas of financial planning. Having a financial planner who is willing to refer you to their colleagues prove they have your best interest at heart.

9. Hire a Financial Planner through a written agreement

It’s always a great idea to manage professional relationships legally. Draw out the financial planner’s job scope and objectives in writing to avoid future misunderstandings and disputes.

10. Hire a Financial Planner from SmartFinance

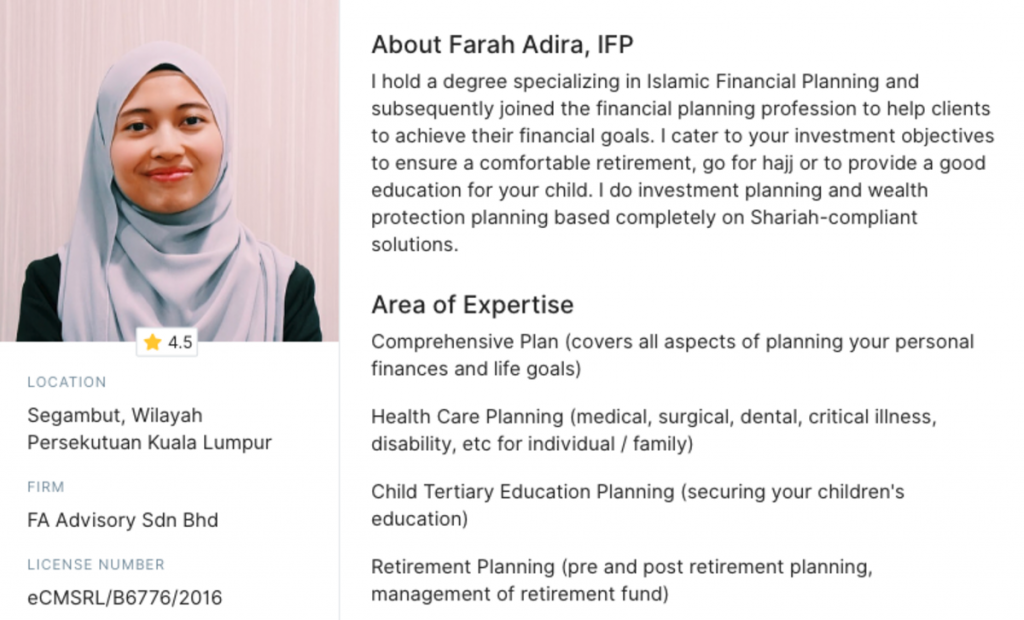

To more easily find a financial planner who suits your need, use a free website like SmartFinance. The website only feature licensed financial planners based in Malaysia, each with their own specialisations.

Use the website to speak to more than one financial planner until you are able to select one whom you trust with your financial information and financial future. You can read their profiles and chat with them online for free before making any official commitments.

BONUS. Hire a Financial Planner After You Gain Basic Financial Literacy

The best investment is your own education. Familiarise yourself with some basic financial planning concepts, so that you would understand what your financial planners trying to coach you.

In fact, SmartFinance has a free lessons library for Malaysians who wish to learn basic financial planning concepts on their own pace.

Conclusion

Taking the time to determine what you require from a financial planner is really the first step towards deciding how closely you will be working with the financial planner.

The right financial planner should understand your overall situation, offering you unbiased advice on your portfolio and its relationship to your life’s goals, risk management plan and an analysis on your wealth protection gaps, as well as business, tax, legal and succession issues.

Good luck!

Useful Websites

Securities Commission:

www.sc.com.my

www.sidc.com.my

Financial Planning Association of Malaysia:

www.fpam.org.my

Bank Negara Malaysia:

www.bnm.gov.my

No Comments