10 Oct How To Overcome A RM1,700 Monthly Deficit To Buying 3 Properties Worth RM 1.1 Mil?

A story of a typical Malaysian walking a path less travelled

By Ka Hoe

“Where do I go?” “Who can I turn to?”

I met Ian (not his real name) when I went back to serve as a coach in one of the property investment courses I previously attended in 2013. He was introduced to me by a friend, who said that I needed to help him.

During our first meeting at Old Town Coffee at Kuchai Lama over lunch, Ian shared with me that he was working as a Graphic Designer & has been working for more than 10 years but finds it very hard to have any savings. I see him as someone who has a dream, and ambition because he told me “People around me, my colleagues, friends and even relatives have already had their own families and even owned a few properties”. Yet he is still single and hasn’t bought his first property nor started any investment.

“Here is what his situation looks like”

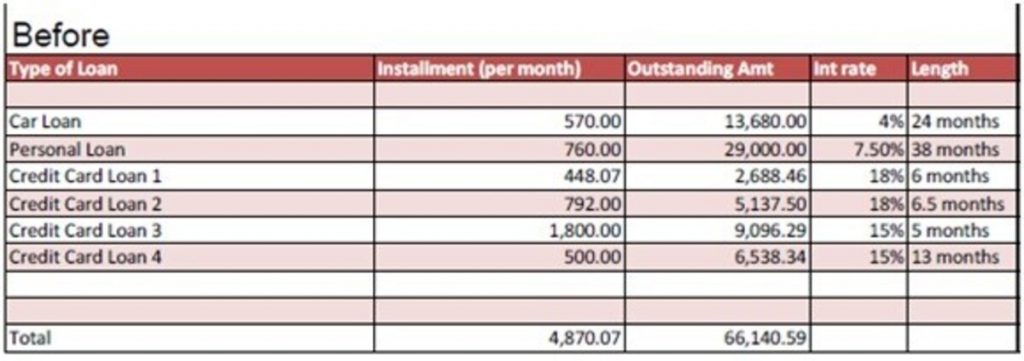

This was his situation

- Credit card debts, personal loans & Car Loan close to RM 66,000

- Negative cash flow of RM 1,767 (Outflow more than monthly salary)

- Earns RM 5000/month salary

- His CCRIS has been badly affected, as he wasn’t prompt in paying his debts

- Total commitments and loans of RM 4,870/month (97% of his salary)

“To be honest…..”

To be honest, I thought he was in a worse-off situation. But after reviewing his situation, I share with him 2 strategies to resolve his situation. One strategy – Debt Consolidation Strategy, as he had multiple loans which needed to manage. 2nd strategy was to use the World’s Simplest Money Management System, which help him not to fall back into the same situation moving forward.

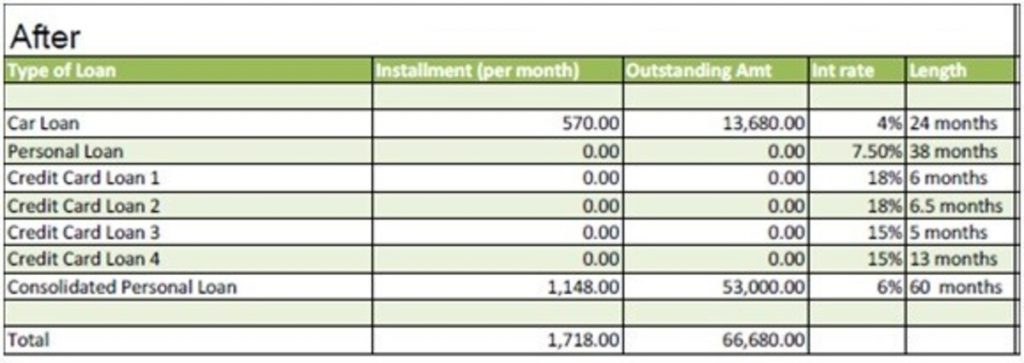

Here is how his situation before & after look like

” If there’s the slightest chance for you to make a change in your life, don’t let go of it. Keep moving and going and you will find a way.”

After applying the strategy, he had

- Reduce RM 3,152/month after restructuring his debts from RM 4,870 to RM 1,718 per month

- Overall Ian could now save RM 1,650/month as a result (Monthly salary having surplus)

- Save on interest of 7-9% on average for his credit card debts & personal loans

- He bought his 1st property for RM 200K & subsequently another RM 900K with his property investor team

- Avoid being ‘EARMARKED’ by not going to AKPK else he wouldn’t be able to buy property. (I don’t have anything against AKPK, as they genuinely help people restructure their debts, they need you to pay off your debts fully before taking on new debts)

“Ian was a Mr Nice Guy to others, but is he nice to himself?”

So with these 2 financial strategies, Ian can free himself from his debt problem & pursue his dream of owning his own property. What I notice about Ian was, that he was an easy-going and easy to ‘trust people kind of guy’ which led him to this problematic situation.

This same trait led him to trust his friend, his friend’s MLM products because he didn’t know how to say NO. And as a result, he doesn’t know how much he has spent over the years. After this experience, he is much more aware of his financial situation.

“So, how do you restructure your loans when your CCRIS is koyak?”

“How do you qualify for more loans since Ian’s CCRIS is koyak?” If this is the same question you are wondering about, congratulations! It means 2 things. Firstly you are very aware of what you are reading and you probably have a high Financial IQ. Secondly, you could be in the same situation and you need help. Regardless, the solution to your problem is simple but not easy if you are not equipped with proper financial education.

For more real-world case studies, you can reach me at my my blog – https://jadvisory.asia/

Ka Hoe is a Licensed Financial Planner having a “Financial Adviser Representative” (FAR) with Bank Negara and “Capital Market Service Representative License (CMSRL) – Financial Planner” with Securities Commission. He is also the Founder of J Advisory, a Personal Finance Academy that helps struggling Malaysians elevate their financial well-being with proven tools, systems and strategies.

DISCLAIMER – All strategies listed here are not a recommendation or advice. The article is written purely for the purpose of education and journaling only. The content of this article is an expression of my opinion and should not be taken as professional advice. If you are seeking professional advice, please consult me personally. You should do your own research and/or seek expert advice when overcoming your debt circumstances.

No Comments